For homeowners and buyers alike, understanding the real estate market is key to making smart financial decisions. CoreLogic’s latest Homeowner Equity Report for the fourth quarter of 2024 reveals some big changes in homeowner equity across the country.

While overall homeowner equity increased by $281.9 billion (1.7%) compared to the previous year, the gains were smaller than those seen in past quarters. On average, homeowners with mortgages gained about $4,100 in equity—a lower increase than the $6,000 gain from Q3 2023.

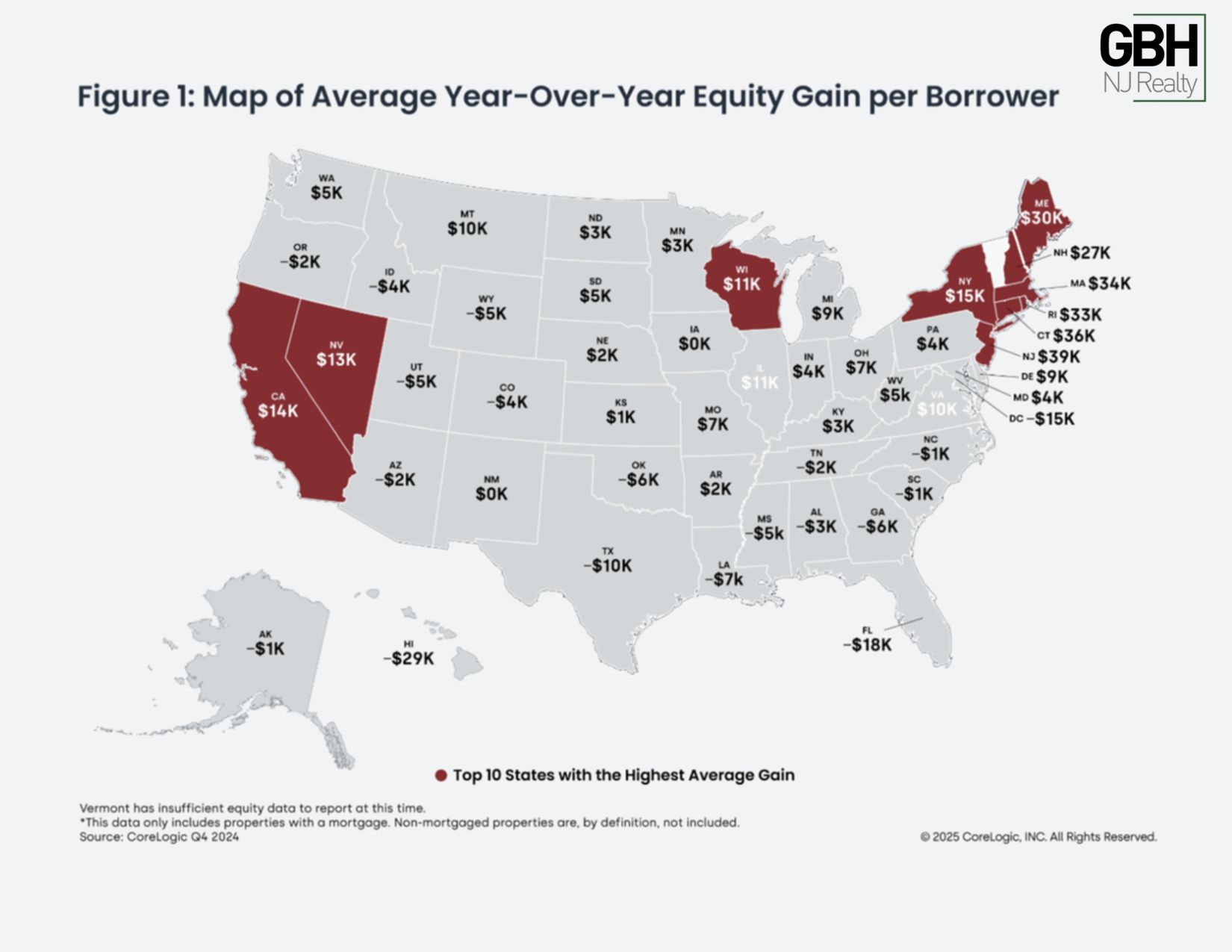

Where Homeowners Are Gaining and Losing Equity

Not all states experienced the same trends. Some states saw significant increases in home equity, meaning properties in those areas grew in value:

✅ New Jersey: +$39,400

✅ Connecticut: +$36,300

✅ Massachusetts: +$34,400

Meanwhile, some states saw home values drop, leaving many homeowners with negative equity—meaning they owe more on their mortgage than their home is worth:

❌ Hawaii: -$28,700

❌ Florida: -$18,100

❌ Washington, D.C.: -$14,700

Negative equity can be stressful for homeowners, as it makes selling or refinancing much more difficult. However, market conditions constantly change, and strategies exist for homeowners who find themselves in this position.

What This Means for Homeowners

If you’re in a state like New Jersey, where home values are rising, you may have built up significant home equity without realizing it. This equity can be used to:

✔️ Sell your home for a profit

✔️ Refinance for better loan terms

✔️ Take out a home equity loan for renovations or debt consolidation

On the other hand, if you’re a homeowner in a state with declining equity, it’s important to:

🔹 Stay patient – The housing market fluctuates, and values could rebound

🔹 Consider renting out your home instead of selling at a loss

🔹 Explore mortgage assistance programs if you’re struggling with payments

What This Means for Buyers

For buyers, these equity shifts create both opportunities and challenges. In states like New Jersey, rising home values may mean higher competition and pricing, but they also signal a strong, stable market for long-term investment.

In states where equity has declined, buyers may find better deals on homes, but they should be cautious of areas where values may continue dropping. A knowledgeable real estate agent can help you navigate these market shifts and find the best opportunities.

Real estate trends can be unpredictable, but working with professionals who understand the market makes all the difference. Whether you’re looking to buy, sell, or figure out your next steps, partnering with an experienced agent ensures you get the best guidance in today’s changing market. Contact your local GoodBuy Homes NJ Realty agent today!